Jump to other articles:

St Kitts and Nevis CIP Offers Alternative Investment Option

In an exclusive interview, as part of Latitude and RIF Trust’s new RCBI Spotlight Series, hosted in their Dubai office, Les Khan, the Head of St Kitts and Nevis’ Citizenship by Investment Unit, discussed in depth the newly-launched Alternative Investment Option (AIO), among other interesting developments.

The new Alternative Investment Option (AIO)

The new AIO is currently live and available to St Kitts and Nevis Citizenship-by-Investment Programme applicants, and Latitude and RIF Trust have already begun processing applications under this new option.

Les Khan gave us more details regarding the AIO stating there are two branches of the new investment option; the privately-funded privately-owned developments option, called a Private Enterprise Developer (PED) and the privately-funded state-owned option, called a Public Good Project Developer (PGPD).

Les Khan explained: “Earlier, we passed legislation to allow non-hotel, non-condominium projects to be considered under the Citizenship by Investment programme. When we did so, we created two categories, one for privately-funded privately-owned and [the second being the privately-funded state-owned option]. “

Under the first Private Enterprise Developer option – the privately-funded privately-owned development AIO – developers will put up their own money to construct their own project as long as it aligns with the government’s mandates. The first approved PED development under this option comes in the form of three-bedroom housing villas where investors can purchase shares for a minimum of USD 200,000 to qualify for the Citizenship by Investment Programme.

Under the umbrella of privately owned AIO, it is a one-time sale only option and cannot be resold, as the developers themselves will recoup ownership of the share after a seven-year holding period. The purpose is to allow the developer to sell them to resident nationals of St Kitts and Nevis at a lower rate than that of the National Bank.

This route will provide investors with an alternative option to the traditional real estate route while providing the local residents on St Kitts and Nevis with high-quality housing at an affordable price.

Les Khan continued by highlighting that the introduction of the AIO will help meet the increasing demand for St Kitts and Nevis’ Citizenship by Investment programme as well as directly address the needs of applicants, especially those that emerged during the pandemic:

“We are seeing a lot of interest coming in. Many Americans require villas on the island, which allows them to own something that is not a hotel, not a condominium, and you know their home away from home. I mean, you’re mentioning this beautiful [country] St Kitts and Nevis, and we’ve seen that trend, especially after COVID, and people wanted to be there for life”, he said.

The second Private Good Project Developer option – the privately-funded state-owned AIO – will focus on developing the country’s correctional facility, which is in need of immediate updating.

This PGPD route provides investors with a cost-effective route to citizenship, starting at USD 175,000 for a family of four. It is a timely introduction since St Kitts and Nevis’ Limited Time Offer (LTO) on the Sustainable Growth Fund option ended on 31st December, 2021. Under the now-expired LTO, families of four could obtain citizenship for a donation of USD 150,000. However, since the offer expired, the donation amount has gone back up to USD 195,000, making the correctional facility AIO option the most economical for families.

Les Khan emphasised the importance of introducing a new investment option that focuses on developing the country’s infrastructure while maintaining cash flow into the government’s coffers. He also gave some insights into how it differs from the previous investment options, saying:

“The second category is the privately-funded state-owned. This is where it meets a government infrastructure need. In this particular case, it’s a new correctional facility. Our correctional facility was built in 1840 […], so it’s really outdated and needs updating. We have identified this as the first infrastructure project that we’d like to do under the Alternative Investment Option.”

“Now, this is slightly different from real estate because it’s a government-funded project or a government-initiated project. The pricing is less, it’s USD 175,000 for a family of four, and they will be paying government fees to the country. The country benefits in two places: we get government fees and we get a project completed. This is a significant advantage to us and very different to some of the other programmes that might be around in the region. We thought [about] this and about how the country can benefit on both sides.”

New Embassy In Abu Dhabi

Les Khan, who made a special visit to Latitude and RIF Trust’s Dubai office this past November while attending the Dubai Expo alongside the Prime Minister of St Kitts and Nevis, discussed the opening of the St Kitts and Nevis embassy in Abu Dhabi.

“The main reason for me being in Dubai has been the Expo event here, and the Prime Minister of St Kitts and Nevis had a special occasion at the Expo […] As a result, we took the opportunity to engage him in other activities around CBI. Now the Prime Minister will do his diplomatic activities. He’s also opening our embassy in Abu Dhabi tomorrow, so his schedule is very tight. After today’s event, which you know has a lot of political activities, tomorrow’s event will be in Abu Dhabi, and it will be the formal opening of the Embassy of St Kitts and Nevis in the UAE.”

“I think it’s a great thing to have the embassy here and for Justin Hawley, our ambassador, to take up that role and… continue to provide services to our citizens in the region.”

“The opening of the embassy is an attestation to the continued efforts of the St Kitts and Nevis government to better serve its citizens throughout the globe.”

Enhanced Global Mobility

Les Khan also updated on the progression of the St Kitts and Nevis passport global mobility, announcing that the Caribbean country’s government continues to work tirelessly to sign new visa-free travel treaties with key countries.

“We announced two additional countries. I heard the Prime Minister talk about 161 countries that we now have visa-free entry (or visa upon arrival) to […] we are really doing very good in putting up those numbers based on our international relationships.”

The St Kitts and Nevis passport currently ranks 26th worldwide and has the greatest global mobility in terms of total visa-free countries amongst all the OESC members. The St Kitts and Nevis passport grants entry into various travel hotspots worldwide, including the EU, UK, Singapore, amongst many others.

On Processing Times

Les Khan says that St Kitts and Nevis continued to perform admirably and that the new Escrow legislation introduced by the unit helped the real estate option along.

“We’ve tightened up our programme with this escrow bill. This benefits the clients and the country because we are ensuring that construction continues and is completed by holden funds in escrow”, says Khan.

St Kitts and Nevis had adapted their operations to deal with lockdowns and remote work, and the Caribbean country set out the roadmap for many other Citizenship by Investment programmes to follow. While the country does not release statistics regarding its programmes to maintain applicant confidentiality, Les Khan did confirm that passports were being issued and that demand was growing.

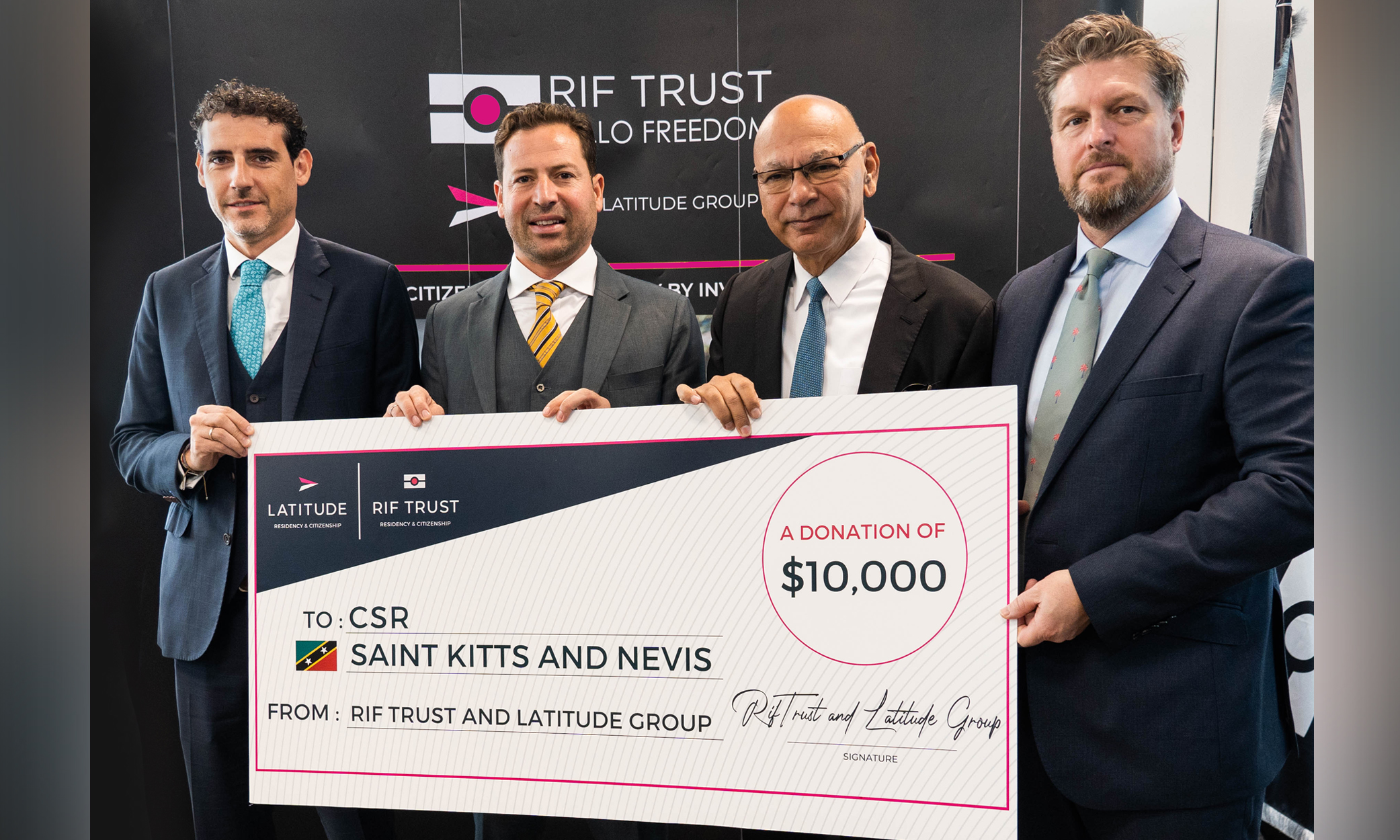

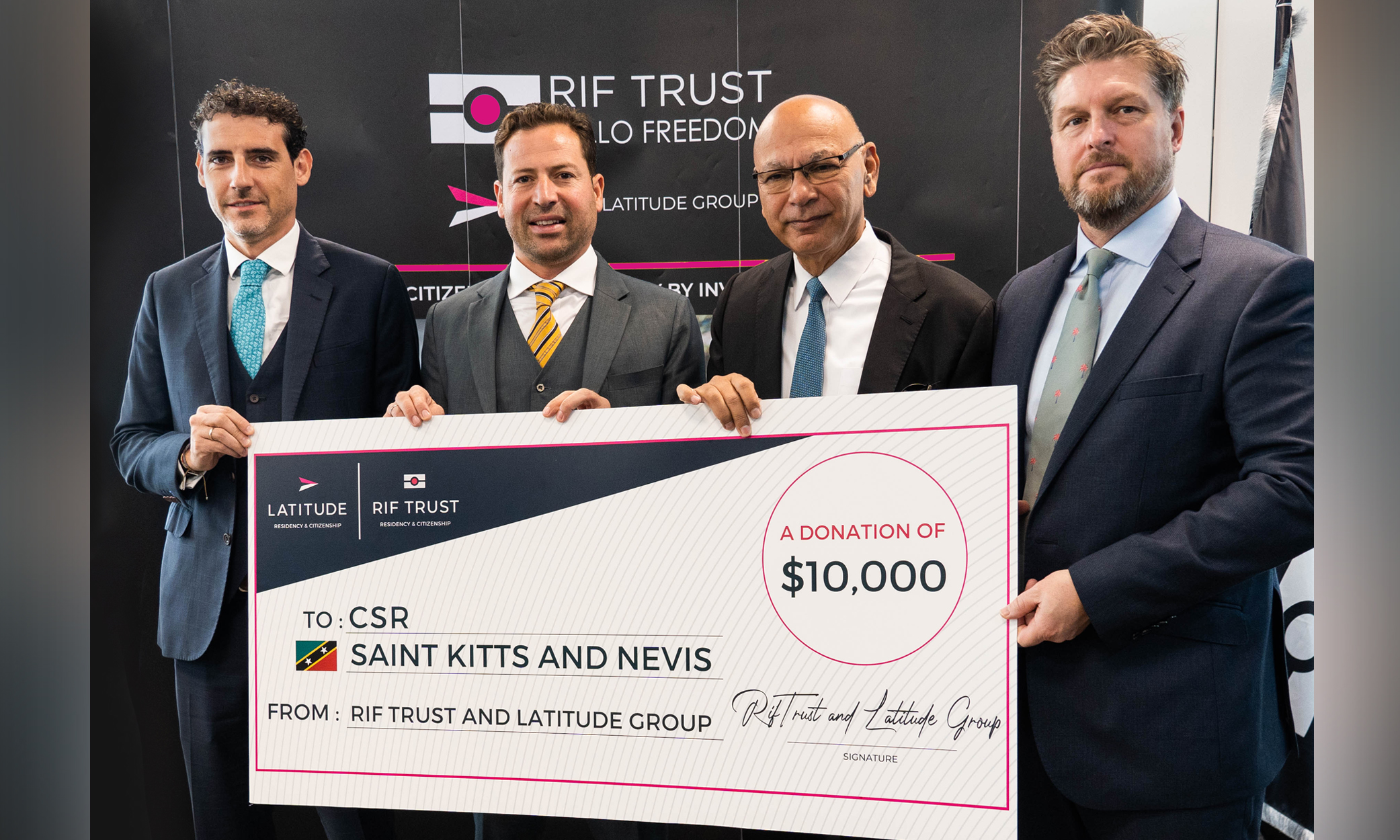

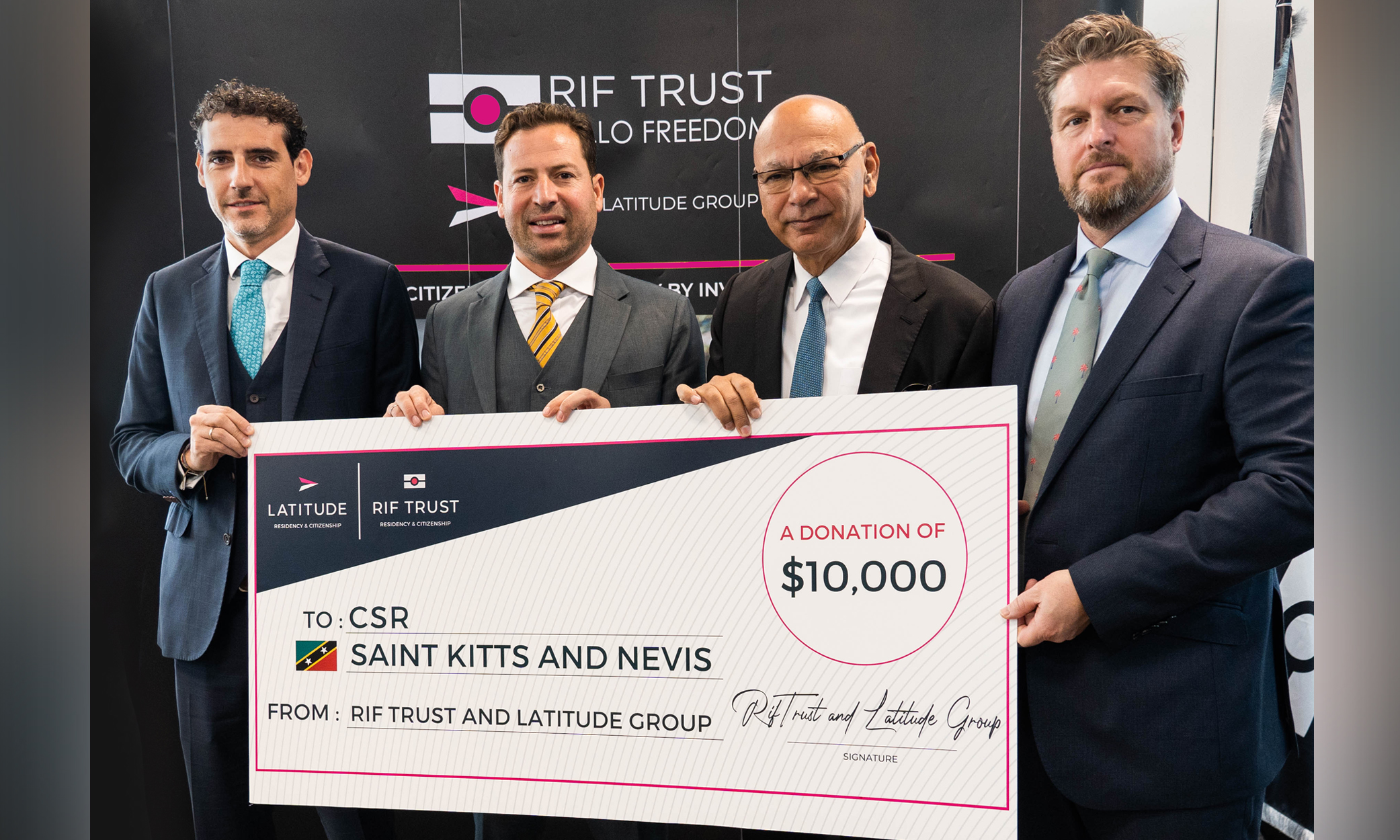

A Long, Fruitful Relationship With Latitude and RIF Trust

Latitude and RIF Trusts’ strong relationship with the St Kitts and Nevis Citizenship by Investment Unit is held in great standing, as they continue to provide the unit with unparalleled support from all their 20 offices worldwide, ensuring their clients obtain the best possible service.

Les Khan himself mirrored this sentiment, stating: “RIF [Trust] has always been a supporter of St Kitts and Nevis since the Hurricane Fund. I remember that discussion we had at the consulate, and our relationship has continued since then, and it’s been a good relationship with RIF Trust”.

He then went on to compliment his long-standing relationship with Latitude saying: “Our relationship with Latitude has gone back a while. I mean Eric Major, Chris [Willis], and I have known each other for a long time, so having Latitude be part of this relationship, this total relationship with RIF, and St Kitts and Nevis to me has just expanded the opportunity.

A Great Year Ahead

Latitude and RIF Trust, alongside Les Khan himself, look forward to 2022, hoping it will be an outstanding year for St Kitts and Nevis, our staff, and our clients. The new AIO will certainly play a part in making that happen, as many clients have already chosen this option as their route to obtaining a second citizenship.

Having known about the option before it was even launched, we were able to guide our clients through it, providing them with the most effective – and economical – global mobility solution for them and their families. We aim to maintain our standard of excellence throughout the year, providing the best service to all clients who walk through our doors.

Back to News

Back to News